In April 2010, Middlebury announced that it would be joining Dickison College and the Rockefeller Brothers Fund in investing a portion of our endowment in a “Sustainable Investments Initiative.” This co-mingled fund is managed by our mutual endowment manager, Investure.

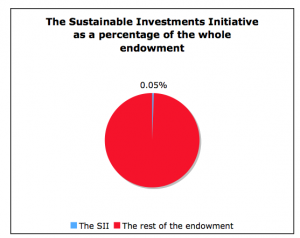

Middlebury dedicated $4 million to this new fund! (This amounts to about 0.05% of our endowment.)

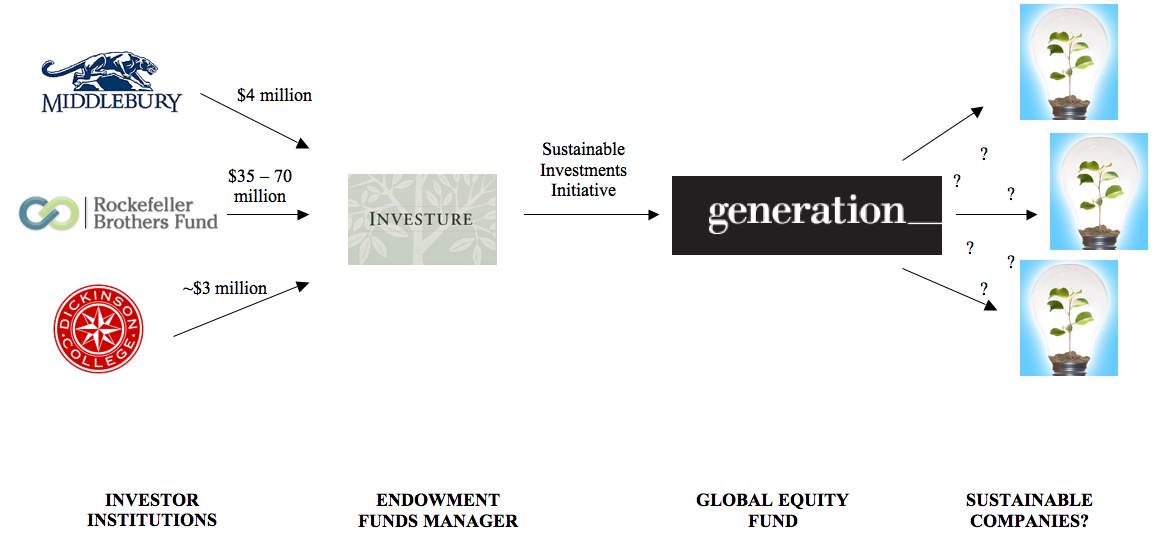

Our student group, the Advisory Committee on Socially Responsible Investment, is charged with evaluating this sustainable investments fund. The first step in evaluating the fund, is getting information about where the investments are. This is harder than you might think since our investment process is kind of like a chain with different decision makers at each step.

First, Middlebury (and Dickinson and Rockefeller Brothers) inform Investure what amount of money they would like moved into the sustainable fund. Then, Investure takes that amount and transfers it to Generation (a fund manager established by Al Gore). Then Generation chooses companies to invest our money in.

Here’s what this process looks like…..

So, we were given a list of the TOP 10 companies in Generation’s fund. These companies only equal about 38% of the fund. So anything we present here is still a limited view of the entire fund. But that, aside, our question becomes: Are these companies “sustainable?” And what does “sustainable” mean after all?

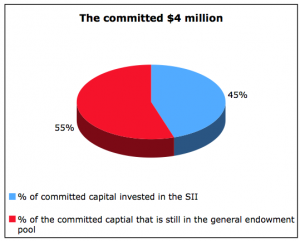

Investure has only transfered 45% of the money that Middlebury dedicated to the sustainable fund. The other 55% is still in our general endowment, waiting to be transfered.

Investure has only transfered 45% of the money that Middlebury dedicated to the sustainable fund. The other 55% is still in our general endowment, waiting to be transfered.

So our second question is: How should these remaining 55% be invested?