The federal government pays benefits to coal miners impacted by pneumoconiosis, commonly known as black lung disease, and other mining related diseases. There are two sources from which disabled coal minder receive funds. One is from the Black Lung Disability Trust Fund and the other is from disability benefits. At the beginning of 2019, funding for federal black lung benefits was cut in half.

The Black Lung Disability Trust Fund gets its primary source of money from a tax on coal domestically. According to the Congressional Research Service, “For 2018, the tax rates on coal were $1.10 per ton of underground-mined coal or $0.55 per ton of surface-mined coal, limited to 4.4% of the sales price. These rates were established in 1986. Starting in 2019, under current law, these tax rates are $0.50 per ton of underground-mined coal or $0.25 per ton of surface-mined coal, limited to 2% of the sales price. These are the rates that were set when the trust fund was established in 1977.”

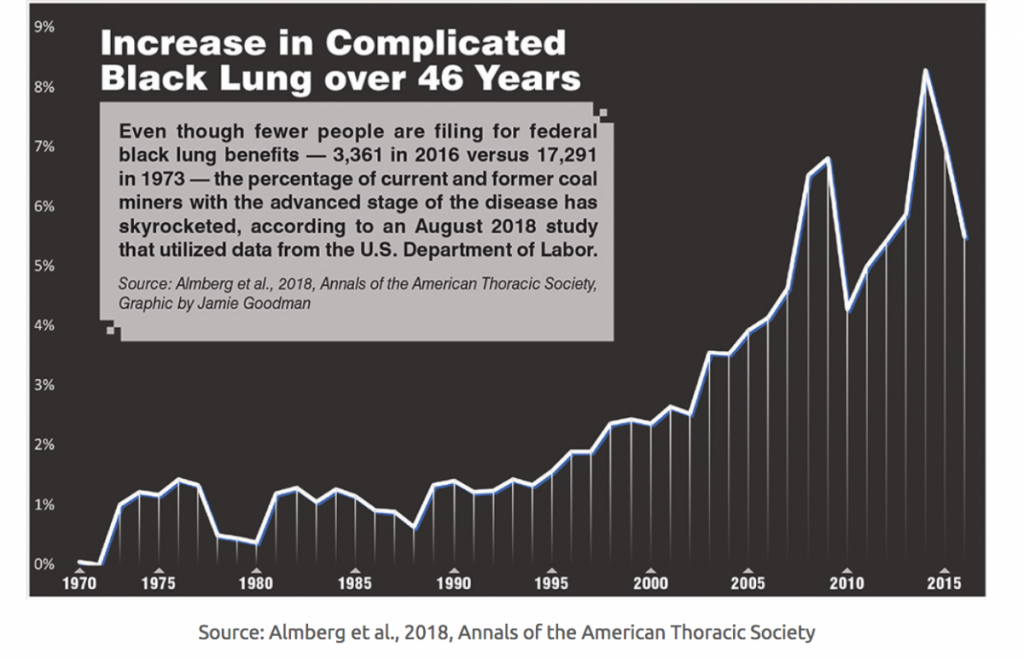

Gabriel Winant’s article “Dirty Jobs, Done Dirt Cheap: Working in Reality Television,” delves into people’s fascination with dangerous working class jobs such as coal mining. For example, the television show Coal follows Cobalt Coal and their attempt to earn millions in the fast-paced world of mining. Instead of portraying the harsh realities coal mining, Coal paints the work as exhilarating. Although this may be entertaining for viewers, greater attention must be paid to the negative long-term health consequences many workers encounter. In reality, many coal miners develop lifelong disabilities and become reliant on disability benefits once their mining careers are over.